This is a brief explanation of what occurred in the Northville and Novi residential real estate market in 2016, as well as what we expect in 2017.

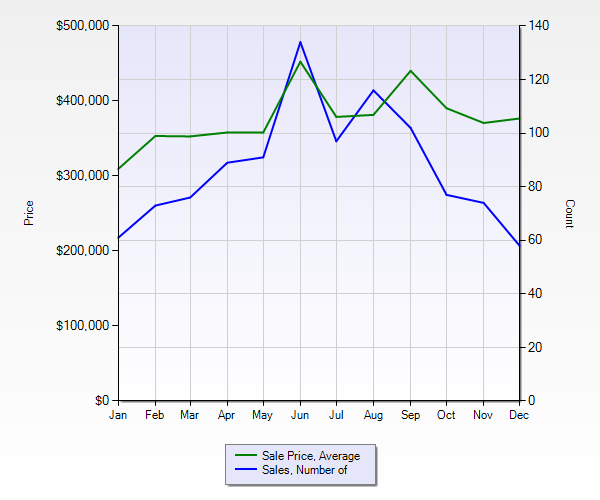

2016 was a year for growth in Northville and Novi home prices: 8.3% to be exact. As expected with that kind of growth, the number of homes that sold went down slightly from 1,086 in in 2015 to 1,048 in 2016. With low interest rates, less for sale, and a plethora of hungry buyers wanting to be in these desirable cities, it’s no surprise that home prices went up for the seventh year in a row.

Mortgage rates went up too. January 2016 rates were 4.0%, dropped over the summer, and rose back to 4.3% by December. Erik Martin with “The Mortgage Reports” concluded that interest rates should continue to increase slightly next year based on expert consensus. Of course, this is assuming the economy is strong and stays that way.

Considering Northville and Novi follow the same economic trends as the nation, it’s safe to assume that our 2017 forecast is similar: Buyers will act quickly to take advantage of rates before they go up. Those buyers will likely be going after starter homes too, considering they haven’t risen in value as quickly as higher end homes. Expect starter homes to be hot commodities in 2017 while higher end homes’ value increase at a slower rate (or peak), giving starter homes a chance to catch up.

The combination of expensive homes, increasing mortgage rates, and relatively stagnant average household income could make 2017 the year we see a shift towards a buyers market (a market where a lot of homes start going up for sale because of the high prices, but the number of eligible buyers are limited). Whether that shift occurs this year or further down the road is up to fate, as well as the performance of the economy.

In summary: 2016 was a great year for Northville and Novi. Prices went up and home sales were steady. Assuming the 2017 economic forecast stays the same, this year we should start a shift from a sellers market to a buyers market. That shift is occurring for good reasons though: economic growth forcing interest rates to finally rise and high home prices. See you at the same time next year!

*Adam Somers has a Bachelors Degree in Finance from The University of Michigan and has been a Realtor for over 3 years with the DiMora Team. All data in this post was derived from Realcomp II Ltd., FRED (Federal Reserve Bank of St. Louis), and an interest rate analysis from Erik Martin at The Mortgage Reports.

Adam Somers

Adam Somers

REALTOR®, DiMora Team

(734) 751-5508

adam@dimora.com